Latest projects

Our expertise lies in establishing close working relationships with destinations, businesses and cultural organisations to develop sound insight and evidence-based advice. We have extensive knowledge and experience of managing impact studies, consumer, business and opinion surveys.

Destination Projects

-

National Trust - Flatford Audience Research, 2023

The study, commissioned by The National Trust, sought to produce insights about the profile, needs, motivations, and interests of visitors to Flatford. It also investigated those that are not currently visiting, including the barriers to engagement.

The research used a multi-mode methodology. Face-to-face interviews with consumers were conducted at a variety of sites within Flatford.

This was complemented with an online self-completion survey using a national online consumer panel. This allowed us to interview visitors on-site as well as past visitors and those who had not visited Flatford before.

The findings of the study are based on a sample of 450 face-to-face interviews and an online sample of 1032 interviews.

-

Visit Essex LVEP - Colchester Consumer Research - Travel Patterns, 2023

Visit Essex LVEP wanted to conduct consumer research to understand the travel patterns of visitors, where they are coming from, how they are getting to Colchester city centre, and barriers to sustainable travel.

Destination Research was commissioned to conduct the research using existing databases.

The consumer research consisted of an online survey, which was created and managed by Destination Research and distributed by Visit Essex LVEP. The survey ran for two weeks, and a total of 238 responses were received.

-

Ramsgate Town Council, Active Ramsgate – Consumer Survey, 2023

Destination Research was commissioned to deliver consumer behaviour research for Ramsgate Town Council in order to build a better understanding of its target audiences, their behaviours and motivations. The results presented in this report are based on an online self-completion survey. The survey delivered a total of 537 responses, covering four target groups identified by the client, based on different life stages and geographical areas.

-

White Cliffs Country, Dover District Consumer Survey, 2023

District-wide visitor research, conducted in partnership with Visit Kent, built on insights gathered in 2017. The study used a multi-mode methodology. Face-to-face interviews (971 interviews) conducted in Dover, Deal, and Sandwich, analysed visitors on-site, their profiles, behaviours and motivations, as well as their experiences, perceptions, and interactions with the destinations. The online panel survey (818 complete responses, 406 by current visitors and 412 by non-visitors) captured the views of current visitors as well as the opinions, associations, and barriers of non-visitors and lapsed visitors to White Cliffs Country.

-

Go Southampton Consumer Survey, 2022 and 2023

Destination Research was commissioned to deliver consumer behaviour research in Southampton city centre to gain insight into the types of people visiting the city, why they visit, and their communication preferences.

Our approach involved using a multi-mode methodology. We conducted 450 face-to-face interviews with consumers at a variety of sites within Southampton city centre.

In addition to conducting in-person interviews, we also developed an online self-completion version of the questionnaire that was made available via Visit Southampton's online channels.

Additionally, we conducted controlled consumer sessions with difficult-to-reach groups like people with disabilities and members of ethnic minorities.

Combined, these activities generated an overall sample of 590 responses.

-

Great Yarmouth Visitor Survey 2021, 2022 and 2023

Destination research was commissioned to conduct a consumer survey among visitors to the borough. The aim of the study was to produce a clear and robust understanding of the profile and characteristics of current visitors to the area, a measure of their levels of satisfaction, and their marketing preferences, to facilitate future targeted communications to both existing and new visitors to the area.

The survey was undertaken over a three-month period, starting at the end of June 2021. The results were based on a total sample of 450 interviews.

-

Experience Oxfordshire – Perceptions Research – Visitors and non-vsitors' Survey, 2023

Oxfordshire visitors and non-visitors were polled in a consumer survey by Destination Research.

The aims of the study were, firstly, to understand the current perceptions of the region as a tourist destination in order to identify potential markets and future marketing strategies. The second objective was to ascertain the characteristics of recent visitors and the obstacles facing those who do not yet frequent the county. Finally, the survey results measure levels of awareness of recent Experience Oxfordshire marketing campaigns as well as the latest impacts of COVID-19 and the cost-of-living crisis. The results are based on an online survey with a sample of 519 consumers who registered to receive information from Experience Oxfordshire.

-

Experience Oxfordshire – Perceptions Research – Residents Survey 2023

Destination Research was commissioned to conduct an online survey among Oxfordshire residents.

The aims of the study were to, firstly, understand the current perceptions of the importance of tourism to Oxfordshire’s economy and the impacts that visitor activity has on the area. Secondly, it sought to understand the profile of respondents, including their opinions about their most recent shopping trips, key destinations within the county, and comparisons with other destinations elsewhere in the UK. The survey's findings also assess how much people are aware of current Experience Oxfordshire marketing initiatives, as well as the most recent COVID-19 and cost-of-living crisis effects.

The results are based on an online survey with a sample of 307 consumers who registered to receive information from Experience Oxfordshire.

-

Suffolk Growth - Tourism Economic Impact Forecast to 2026

Assessing COVID-19 and the loss to the local visitor economy. We modelled the likely monthly and annual impact on day and overnight tourism in East Suffolk as a result of the pandemic up to 2026.

-

Experience West Sussex – Business Resilience Survey 2023

The study's goal was to assess resilience among businesses in the West Sussex area in light of the high cost of living, long-term effects of the pandemic, and operational challenges affecting the industry. The findings were based on the following:

Desk Research: Contextual analysis from recently published business surveys

Online Survey: using a questionnaire for online distribution using EWS business database of approximately 1000 businesses

Telephone consultations: we targeted a range of businesses and conducted structured interviews following the structure of the outline questionnaire but with open-ended questions designed to capture opinions and suggestions from businesses.

-

Suffolk Growth - Accessibility and inclusion research 2023

The purpose of the consumer survey was to learn more about the factors preventing some people with health issues and impairments from taking vacations. The findings contrast the general population with the group of people who have a health issue or impairment. An online omnibus survey with a sample size of 2,000 adults from across the country was used to collect the responses.

The purpose of the business survey was to examine accessibility in the visitor economy and gauge the amount of accessible travel. Using a telephone research method, we conducted 40 structured interviews with a representative sample of the various kinds of tourist-related businesses in Suffolk.

-

Visit East of England - Tourism Business Survey 2022

The Visit East of England's Tourism Business Survey, supported by local Destination Marketing Organisations and local authorities, received 267 responses and was designed to gauge what work is required to build back the region’s vital visitor economy as quickly as possible and to inform Visit East of England's approach to government, national tourist bodies and to future marketing.

-

2022 World Masters Cyclo-Cross Championships

This report quantifies the economic impact of the 2022 World Masters Cyclo-Cross Championships. It also evaluates participants’ satisfaction with various aspects of the event, their opinions about Suffolk, and future sporting events taking place in the county. The research encompassed four strands:

• Participant survey - an online survey of event participants to ascertain their trip characteristics, demographics, behaviour patterns and levels of expenditure incurred, both on-site and off-site.

• Desk research - assessment of likely expenditure levels by event viewers.

• Event organisers survey - consultations with event organisers to gain an insight into the use of local suppliers and their levels of spend.

• Economic impact modelling - drawing data from each of the above surveys to generate an estimate of the overall economic impact of the event on the local area.

-

North Pennines AONB - Quantifying the Benefits of a Multi-Day Circular Walking Route

Destination Research was commissioned to conduct a consumer survey. The North Pennines AONB and UNESCO Global Geopark Partnership plans to develop a multi-day circular walking route to highlight the special qualities of the AONB. In particular, there was a need to articulate the economic case and identify the potential market for it.

Research Outputs:

- Potential economic benefit of developing the multi-day walking route in the North Pennines: likely numbers walking the route and the economic impact of them staying overnight and using local services such as shops, cafes, pubs, etc.

- Quantification of the potential market, including a typology and segmentation of the UK and international walking markets, with an indication of the likely appeal of a walk of this nature to identified segments.

- The development of personas and customer journeys as an extension of segmentation, helps guide the development of approaches to brand and marketing efforts.

- Identification of the outdoor recreation and wellbeing benefits of creating the route, including specifics of research evidencing it.

We conducted an online consumer survey and mailed it to a database of consumers supplied by Visit County Durham (an overall sample of 1,373 responses).

We also carried out desk research. In particular, we extracted data from the latest Visit County Durham STEAM Model (2019).

Finally, we used our in-house economic impact model (PRIME) to assess the likely economic impact of the new long-distance route.

-

East Suffolk Council - Impact of COVID-19 on East Suffolk Town Centre Businesses

The aim of the study was to survey East Suffolk’s town centre businesses and users across

our 12 key towns and villages to understand the impact of COVID-19 on businesses and

town centre users to support future intervention plans.

As part of the research plan, we interviewed consumers and businesses using a mixed

methodology (face-to-face, online, and telephone interviewing).

We conducted face-to-face interviews with consumers at each of the 12 town centres. We

created a QR code linked to the face-to-face consumer survey. Those wishing to take part in the

consultation but unable to do so ‘on the spot’ were offered a chance to upload the survey onto

their phones so that they could submit the responses in their own time.

We produced qualitative stakeholder surveys to town centre businesses and users across

all 12 of East Suffolk’s towns, including Aldeburgh, Beccles, Bungay, Felixstowe,

Framlingham, Halesworth, Leiston, Lowestoft, Saxmundham, Southwold, Woodbridge and

Wickham Market.

Overall, the results of the study are based on 1517 interviews with town centre users and 492

interviews with local businesses.

-

Visit Essex - Perceptions and Segmentation Research

Destination research was commissioned to conduct a consumer survey among visitors and non-visitors to Essex. The aims of the study were twofold. Firstly, the research aimed to understand the current perceptions of Essex as a tourist destination in order to identify potential markets and future marketing strategies. Secondly, it sought to understand the profile of current visitors and the barriers for those who don’t currently visit the county.

The results included in this report are based on an online self-completion survey from a sample of 2012 respondents (with a mixture of recent, past and non-visitors).

-

Experience Oxfordshire – 2021 Business Survey

Destination research was commissioned to conduct a survey among businesses located in Oxfordshire. The aims of the study were to understand how businesses have managed the impact of the pandemic and the changes in international travel, as well as seek views from the industry to gauge what work is required to build back our vital visitor economy as quickly as possible. The results of the survey will guide Experience Oxfordshire’s approach to government, national tourist bodies, and future marketing. offers full online and mobile functionalities. This report is based on a sample of 114 responses.

-

Experience Oxfordshire - 2021 Consumer Survey

Destination research was commissioned to conduct a consumer survey among visitors and non-visitors to Oxfordshire. The aims of the study were twofold. Firstly, the research aimed to understand the current perceptions of the region as a tourist destination in order to identify potential markets and future marketing strategies. Secondly, it sought to understand the profile of current visitors and the barriers for those who don’t currently visit the area.

The results are based on 500 responses to an online survey with consumers registered to receive information from Experience Oxfordshire.

-

Suffolk Growth - Economic impact of COVID on the Suffolk visitor economy

Suffolk Growth would like to illustrate the projected impact of COVID on the Suffolk visitor economy by assessing the economy and employment and illustrating a modeled sector recovery trajectory over 2021 and 2022. Overall, the assessment will consider the economic (value and volume) impacts and employment.

The results were presented in two waves: The first assessment (produced in January 2021) reflects a snapshot in time based on the latest understanding and a set of assumptions. However, due to the fast-moving and uncertain nature of the industry, subsequent developments are likely to change the outlook. A second assessment (produced in July 2021) presented the projected impacts and “recovery” of value, volume, and employment up to 2022, as well as indicative timings as to when the value of spending might be back to 2019 levels.

-

Great Yarmouth Borough Accommodation Audit

A comprehensive database of tourism businesses in the area was used to measure current accommodation supply in Great Yarmouth, identifying any recent changes in terms of new establishments and closures. Much of this was based on information drawn from existing databases, commercial B2B-purchased data, and extensive online and desk research.

-

Visit East of England - Covid-19 – Online Consumer Sentiment Survey

Destination research was commissioned to conduct a consumer survey to understand the impact of COVID-19 on their behaviour and plans for holidays or breaks to Norfolk and Suffolk, the rest of the UK, and abroad in the months and years to come, with particular focus on the current barriers and concerns around travel and how these will evolve over time. The report is based on a sample of 7,589 responses.

-

Go Trade – Additional Night Analysis and Methodology

A fundamental part of the Go Trade project was to measure the impact of tourism on the partnership’s markets in the UK. Destination research was commissioned to develop a fully explicit and instructional methodology for calculating ‘additional night stays’ that can be attributed to the Go Trade project. for the project area in the UK (Basildon, Gravesham, and Great Yarmouth).

Using the Cambridge Economic Impact Model, we produced modelling estimates for the three UK areas to cover the period from July 2017 to March 2020 (coronavirus shutdown), and then a two-scenario projection, one until December 2022 with business as usual, and a second projection including a COVID-19 impact forecast.

-

Visit East of England - COVID-19 - Regional Online Tourism Business Survey

Visit East of England's Tourism Business Covid-19 Survey, supported by local Destination Marketing Organisations and local authorities, received 776 responses. The results were based on an online survey to businesses in the region, with responses from businesses based primarily in Norfolk and Suffolk but also in Essex, Cambridgeshire, and a few based in Bedfordshire and Hertfordshire. The survey was fully managed in-house by Destination Research using the Typeform software package, which offers full online and mobile functionalities.

-

Ipswich Borough Council - Ed Sheeran Concerts at Chantry Park, Ipswich – Economic Impact Report

Ipswich Borough Council wanted to measure the economic contribution that the four Ed Sheeran concerts at Chantry Park, in Ipswich, made to the local economy. The objectives of the research were to understand and quantify the economic impact of the Ed Sheeran concerts on the local and regional economies and to provide insight into the impact that the Ed Sheeran concerts had on businesses within the local economy.

The research encompassed four strands: an online survey of ticket holders, consultations with concert promoters, an online survey mailed to local businesses, and economic impact modelling, drawing data from each of the above surveys to estimate the economic impact of the Ed Sheeran concerts on the local area. The study also reports on other, less quantifiable impacts and ways to further build the economic benefits that large events like this one could present for the local visitor economy. These additional benefits relate to residents, visitors and local businesses.

-

Suffolk Walking Festival (annually since 2016)

Suffolk County Council wanted to evaluate the success of the Suffolk Walking Festival, which included over 100 walks in a three-week period. We structured the research under three strands of activity: Satisfaction survey: collecting feedback and satisfaction scores for each individual walk using a ‘Have your say’ / tap-screen-style online survey (Typeform) sent out within 24 hours of the completion of each individual walk. A user profile online survey was sent out at the end of the Festival, designed to collect additional profile information, including demographic and customer data. Finally, we used our in-house PRIME Economic Impact Model to assess the likely volume and value of tourism and related expenditure generated by the Suffolk Walking Festival.

-

England’s Creative Coast

As part of England’s Creative Coast (a Discover England Fund project), it was necessary to understand the current perceptions of the coastal area covering Essex, Kent, East Sussex, and West Sussex as a cultural destination. The first phase of this study involved a detailed literature review examining existing perceptions of the south-east coast as a cultural destination, including history, heritage, and the arts. The literature review also highlighted some gaps in knowledge that could only be filled with new primary research (online survey via Facebook promotional ads). The aim of the primary research was to build a profile of key target audiences (France and the Netherlands) based on their interest in cultural tourism.

-

Chelmsford Festival of Art and Culture

The Chelmsford Festival of Art and Culture is a community-led festival. The festival took place around Chelmsford city centre for 10 days at the end of June. Its aims were to raise the profile of the local community by celebrating its distinctive, rich heritage using music, dance, visual arts, and other forms of performing arts. The event organisers identified the need to quantify the economic contribution that the festival made to the local economy, both in terms of employment (jobs created and sustained) and the direct and indirect economic impact on the local area. To achieve these objectives, we employed a mixed methodology, with a combination of a face-to-face survey with festival goers and the use of our in-house economic modelling research (PRIME Model).

-

Deben Peninsula (Suffolk) - Profile, Satisfaction Survey and Economic Impact Evaluation

East Suffolk District in partnership with The Deben Peninsula Coastal Community Team wanted to quantify the value of tourism to the Deben Peninsula as well as to understand who uses the area and for what reason so that they could undertake targeted marketing. The research included the development of a bespoke economic template using Cambridge Model, a visitor survey based on 341 face-to-face interviews conducted across a number of locations within the Deben Peninsula and an online survey of non-visitors with a national panel of 209 respondents.

-

Colchester Residents Survey

The aim of the Colchester town users survey was to understand the characteristics and profile of town users and their satisfaction with various aspects of the town centre. A total of 400 face-to-face interviews were completed with a mixture of residents and visitors. Face-to-face interviews with structured questionnaires were conducted at a variety of locations within Colchester town centre

-

East Suffolk Profile and Satisfaction Survey

A total of 823 face-to-face interviews were conducted at seven destinations within East Suffolk. The purpose of the survey was to understand the characteristics and profile of users, including residents, second-home owners, and tourism visitors, as well as measure the levels of satisfaction with various aspects of the town(s). East Suffolk Council commissioned and funded the survey.

-

Visit Chichester Audit

Secondary research analysis and review of market and lifestyle trends. The literature review provided an indication of the existing levels of information available and highlighted areas where there could still be potential for additional research. The report provided a summary of the key messages from the review of the previous destination studies and key national trends. The coverage of published studies was organised using Visit England’s Section 2 – Gathering the Evidence of Visit England’s Principles for developing Destination Management Plans.

-

Visitor Perceptions and Segmentation - Bury St. Edmunds and Beyond (Suffolk)

Baseline visitor segmentation and perceptions research to inform future marketing activity. Online research with 1500 interviews covered the views of current visitors, irregular and past visitors who are less familiar with the destination product, as well as non-visitors.

The study provided an in-depth understanding of the awareness, image, and perception of Bury St. Edmunds and surrounding areas, referred to as Bury St. Edmunds and Beyond, as a day trip and short break destination, a general picture, and offered additional insight into key markets for both current visitors and non-visitors.

-

Visitor Perceptions and Segmentation - Visit Herts

Visit Herts needed to understand perceptions of Hertfordshire as a tourism destination from the point of view of both visitors and non-visitors. Insights from this baseline research will be used to inform future development strategies, the brand positioning and associated marketing of Hertfordshire, and the destinations and attractions within it.

A structured programme of research included two focus groups with non-visitors and was designed to understand barriers and actual awareness of the place. In addition, an online panel survey (sample 800) targeted a range of recent and past visitors as well as a smaller proportion of non-visitors. The key research objectives included:

• Research the awareness, image and perception of Hertfordshire as a day trip and short break destination

• Provide a general county picture and offer additional insight into key markets—both current visitors and non-visitors.

-

High Speed 1 (HS1) - Tourism Impact Study

An extensive programme of tourism research was designed to measure the impacts of High Speed One (HS1) on Kent’s tourism. The aim of this study was to understand how, and to what extent, HS1 has impacted Kent’s visitor economy since services launched.

The research findings capture organisational and consumer perceptions of the HS1, looking at how the service contributed to the current state of Kent’s visitor economy. The following components were used in this study: a literature review, secondary research, a face-to-face visitor survey, an online business survey, and an economic impact assessment.

-

Salisbury Plain Heritage Centre (Wiltshire)

Evaluation of a new, purpose-built visitor attraction in Wiltshire (Salisbury Plain Heritage Centre). The key element of this project was an online self-completion survey among a sample of 1000 visitors and non-visitors to Wiltshire. It was distributed via a national panel designed to measure the attractiveness of a new, purpose-built visitor attraction named Salisbury Plain Heritage Centre as well as the volume and revenue estimation programme based on the level of attractiveness of the new venue.

-

Landguard Peninsula (Suffolk)

The study included face-to-face interviews at various locations within the Landguard Peninsula. Landguard has several attractions for visitors, and there is a mix of locals and out-of-town visitors. The main challenge was to ensure that we engaged with a wide range of visitors at key locations: out on the nature reserve (picnicking, fishing, dog walking, etc.), the visitor centre, the bird observatory, and even those just sitting in their cars watching the ships at the nearby Felixstowe container port.

-

Hunstanton Visitor Survey (Norfolk)

The focus of the survey is to explore ways to encourage visitors to stay longer or visit more frequently. A mixed-methods study: The questionnaire for staying visitors was made available at all accommodation providers in the town. The survey of day visitors involved face-to-face interviews at selected locations within the town centre and the promenade.

-

Felixstowe Visitor Economy (Suffolk)

A mixed-methods study involving the use of face-to-face interviews and an online survey. The study aims to establish a profile of visitors who come to experience Felixstowe (Suffolk Coast). Particularly, the study seeks to obtain insights about perceptions and satisfaction levels from both visitors and residents using the recently refurbished Felixstowe Seafront Gardens. In addition, the study provides an understanding of the makeup of the tourism industry in Felixstowe and its impact on the employment market. It also quantified the volume and value of tourism to the local economy using the Cambridge Model methodology.

-

Suffolk Perceptions and Segmentation Study

A county-wide online survey of 2500 respondents was designed to determine Suffolk’s tourism strengths, weaknesses, opportunities, and threats, provide segmentation data on the visitor and non-visitor markets, and benchmark the county against other ‘top of mind’ tourism counties.

-

Waveney District Visitor Survey

District-wide, multi-site face-to-face interviews to provide a profile of the various types of visitors, activities, and trip characteristics, as well as quantifying the levels of satisfaction with their visit.

-

Lowestoft (Suffolk) Town Mystery Shopper

The Mystery Shopper Audit involved a number of visits to Lowestoft by one of our expert assessors. We provided an overview of the extent to which the town’s facilities meet industry best practices. Covering key sections including the general aspect of the town, its retail provision, catering facilities, and visitor information, including an audit of the Tourist Information Centre and an assessment of toilets and changing facilities in terms of location and cleanliness.

-

Maldon (Essex) Town centre survey

Face-to-face and telephone interviews were conducted to provide a profile of the various types of town center users, quantify the levels of satisfaction with various aspects of the town centre and establish the perceived impacts (negative and positive) that the provisional Monday Street Market has on the local area from the point of view of users, stallholders and High Street retailers.

-

Halesworth (Suffolk) Tourism Catchment Analysis

Estimate the volume of likely staying visitors within a radius of the proposed leisure development using lower layer super output areas (LSOA). The project involved conducting a full accommodation audit and using the Cambridge Model.

-

Colchester (Essex) Evening and Night Time Economy

Face-to-face visitor survey and desk research to provide a baseline for the types of people using the town centre at differing times in the evening and night and to quantify the economic value of Colchester’s night-time economy. Particular emphasis was placed on assessing the levels of loyalty to the various aspects of the night-time offering and the barriers for visitor growth.

Other Services

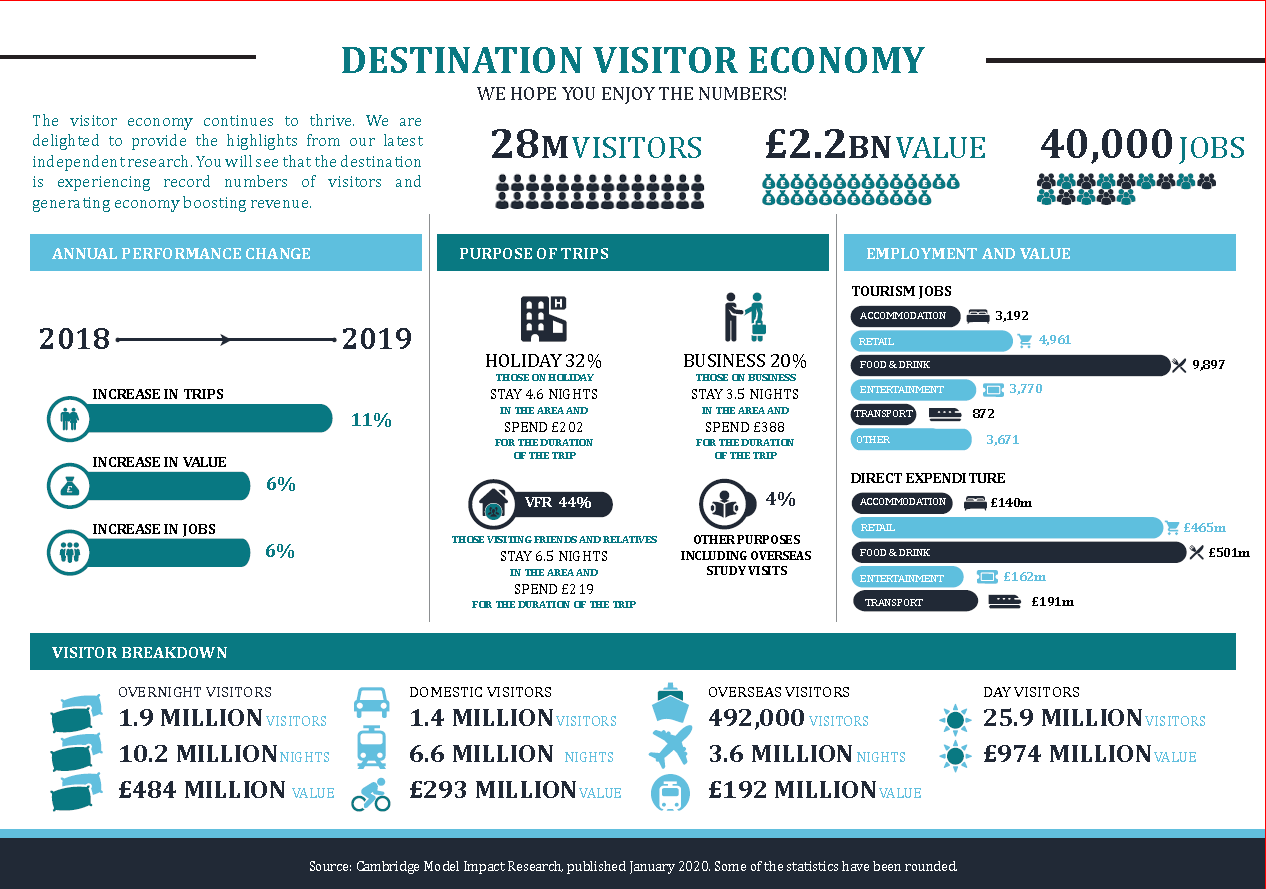

Economic Impact Assessments (Cambridge Model)

As owners of a Cambridge Model licence we are regularly invited to produce 'volume and value' studies for destinations, protected landscapes, and alternative geographies linked to funding projects (e.g. Interreg, DRPE, etc.). We have completed hundreds of assessments. During the last three years, we completed some 200 reports nationally, including towns, districts, counties, and AONB areas.

Most recently, we have expanded our reach to cover the Isle of Man. Previous additions to our customer base include West Sussex (counties and districts/boroughs) and the Kingdom of Fife (Scotland) where we have produced new overall results for the Kingdom of Five and its constituent parts (St. Andrews, Dunfermline, Kirkcaldy, and North East Fife).

Event Impact Evaluations (find out more...)

We regularly conduct economic impact evaluations of tourism, arts, and cultural events using our own economic modelling techniques and multipliers. Our event studies are designed to estimate the overall economic contribution of events to the local and regional visitor economy as well as the direct, indirect, and induced jobs arising from events.

Recent projects include:

- Outdoor festivals

- Arts and cultural fairs, trails, etc.

- Museums and galleries

- Marketing campaigns

- A special event or exhibition.

Marketing Campaign Evaluation (find out more...)

Our studies quantify the return on investment based on ‘additionality’, that is, by measuring the economic impact generated by people visiting as a direct result of a specific campaign.

Most recent campaigns (Visit Essex 2021):

- Staycation Campaign: “Break away from the crowds”

- Locals Campaign: “Make memories close to Home”.

- The Essex coast: “ Experience the unexpected”

Drive Time Analysis

The analysis involves a 60-minute drive-time penetration analysis in order to analyse the likely market demand. We use specialist mapping software to identify tourist ‘hot spots’ within a 60-minute drive-time of the targeted attraction or destination.

Recent projects

- Ferrybridge Boat Yard, Dorset

- Audley End House

- Dover Commonwealth Memorial

- Gainsborough House Art Gallery

Business Monitors (find out more...)

Great Yarmouth: Online Tourism Business Survey 2022/23

Bi-monthly online survey to businesses in the Greater Yarmouth area. The monthly report reflects on the very latest industry sentiment. The reports include a summary of immediate reactions, longer-term recovery plan actions, and general business performance.

- Business Confidence Monitors for Visit Norfolk, Visit Suffolk, and Visit Essex.

- British Destinations: Destination Intelligence

- Isle of Man Tourism: Accommodation Occupancy Survey

Town Mystery Shopper Audits (find out more...)

Our Mystery Shopper Audits provide information useful to those involved in destination management. A standard audit will cover aspects of the town that are important to the quality of the visitor (tourist, day tripper, shopper). The audit evaluates the standard of amenities and infrastructure that visitors can expect when they arrive.

Press Cuttings

Our work is often mentioned in press articles, blog posts, press releases and on partner websites. Below are some examples of recent projects that have been mentioned in the media.